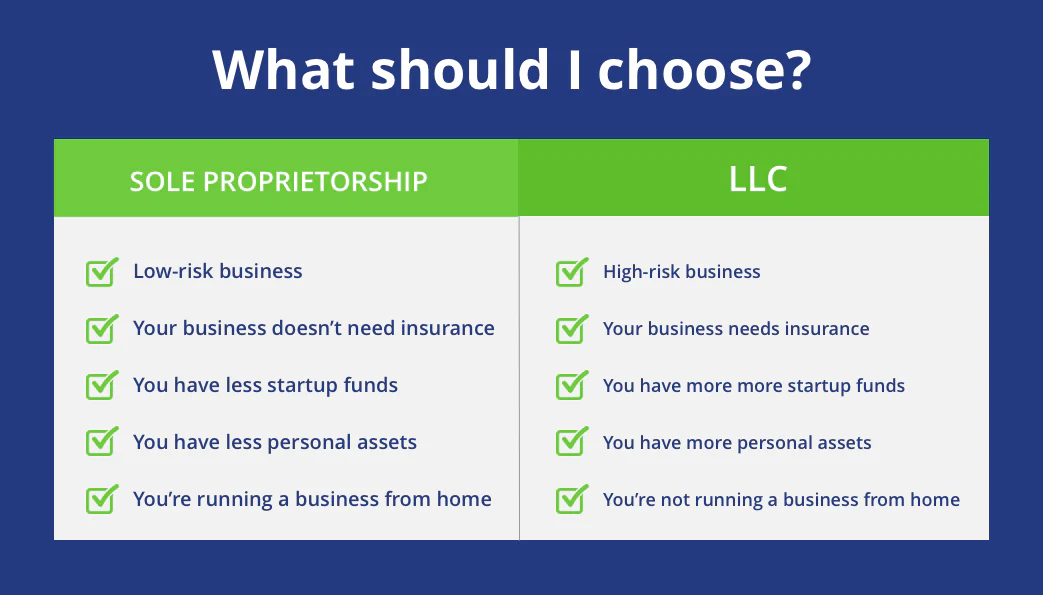

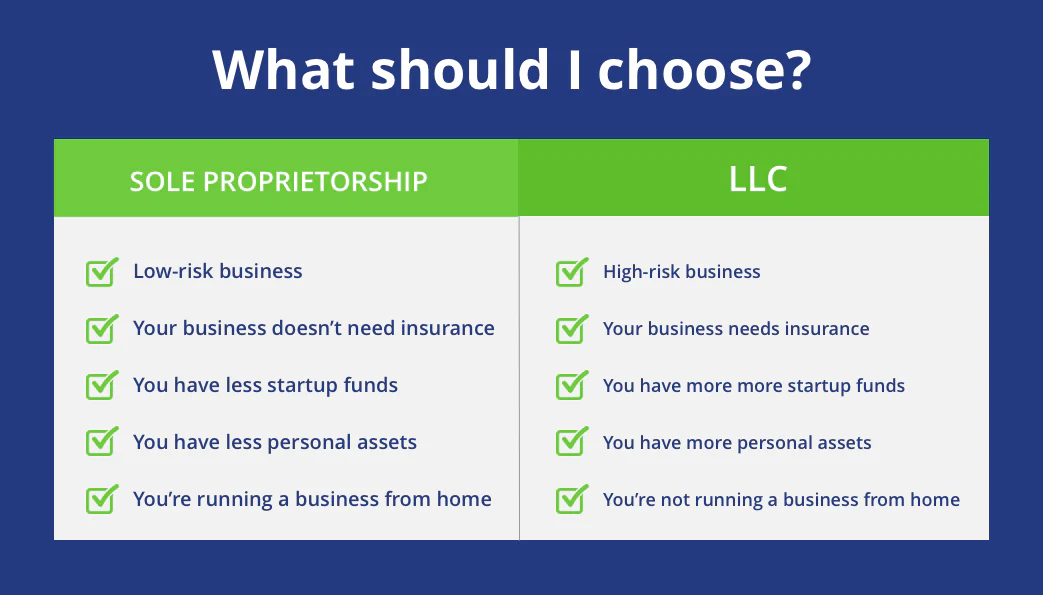

LLC vs Sole Proprietorship: Key Differences You Should Know

Choosing between an LLC and a Sole Proprietorship can feel overwhelming, but understanding the key differences can help you make the right decision for your business. Let’s break it down:

1. Liability Protection

- LLC: Offers strong liability protection. Your personal assets (like your home, car, and savings) are shielded from business debts and lawsuits.

- Sole Proprietorship: No separation between personal and business assets. If your business faces legal trouble, your personal assets could be at risk.

2. Taxation

- LLC: Provides flexible tax options. You can choose to be taxed as a sole proprietorship, partnership, S-corp, or even a C-corp, depending on what works best for your business.

- Sole Proprietorship: Business income is reported directly on your personal tax return, making it simpler but potentially less tax-efficient.

3. Management Structure

- LLC: Can have multiple members (owners) and managers, making it ideal for partnerships or teams.

- Sole Proprietorship: Owned and managed by a single individual, giving you full control but also full responsibility.

4. Legal Formalities

- LLC: Requires registration with the state, an operating agreement, and annual filings. While it involves more paperwork, it also provides more structure and protection.

- Sole Proprietorship: Minimal paperwork and fewer formal requirements, making it easier and faster to set up.

5. Credibility

- LLC: Seen as more professional and trustworthy by clients, investors, and partners. It adds credibility to your business.

- Sole Proprietorship: Often perceived as less formal and smaller in scale, which may not appeal to larger clients or investors.